- STATE OF CA TAX FILE EXTENSION 2016 FOR FREE

- STATE OF CA TAX FILE EXTENSION 2016 HOW TO

- STATE OF CA TAX FILE EXTENSION 2016 PDF

- STATE OF CA TAX FILE EXTENSION 2016 PLUS

STATE OF CA TAX FILE EXTENSION 2016 PDF

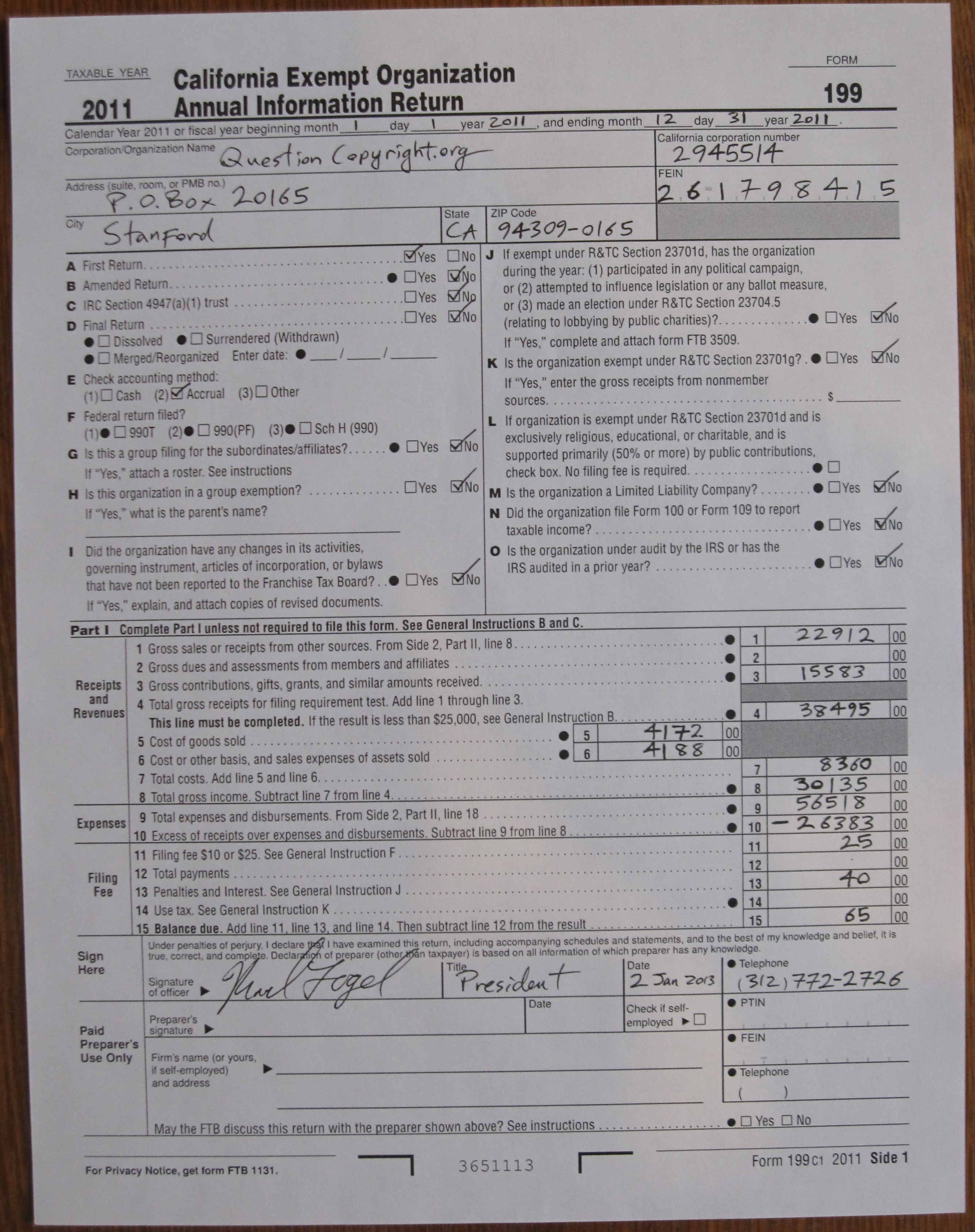

For forms and publications, visit the Forms and Publications search tool. E-file an IRS personal tax extension with Ta圎 File Only a State Tax Extension 5.95 for a State Tax Extension PDF File Your State Tax Extension Now eFile a Personal Federal Tax Extension IRS Form 4868 34.95 Now only 29. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.įorms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page). These pages do not include the Google™ translation application.

We translate some pages on the FTB website into Spanish. if you should file a tax extension, here are several reasons to. If you have any questions related to the information contained in the translation, refer to the English version. That would mean you could file as late as Oct. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Hi Lane, Do I need to file a CA state tax extension for C Corp Or CA gives an automatic 6-month extension Show More.

Consult with a translator for official business. Lane, Do I need to file a CA state tax extension for C Corp Hi Lane, Do I need to.

STATE OF CA TAX FILE EXTENSION 2016 FOR FREE

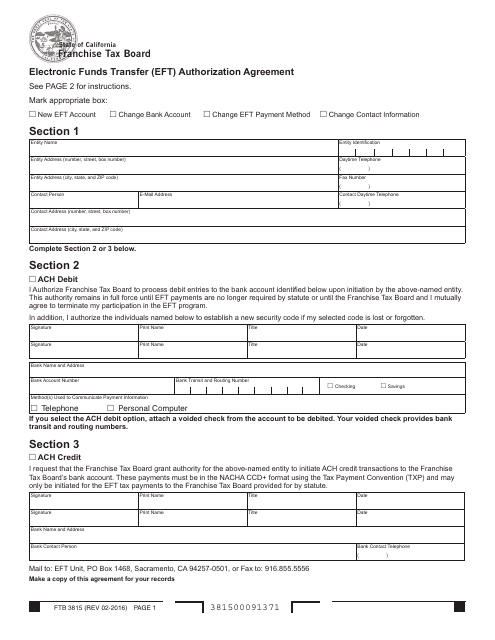

To file for tax extension, you simply need to go to the IRS website or e-File Form 4868 or Form 2350 for free on .īear in mind that getting an extension does not impact upon the date that you have to pay the IRS, which means that you will still have to pay an estimated amount in order to avoid any penalties.This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Taxpayers requesting an extension will have until Monday, October 17, 2022, to file." "Taxpayers in Maine or Massachusetts have until April 19, 2022, to file their returns due to the Patriots' Day holiday in those states. "The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia for everyone except taxpayers who live in Maine or Massachusetts. "By law, Washington, D.C., holidays impact tax deadlines for everyone in the same way federal holidays do," explains the IRS' website. File your return early or before the due date to avoid being charged interest and penalties and to prevent a disruption to your benefit and credit payments, such as: GST/HST credit, including. For most people, the 2021 return has to be filed on or before April 30, 2022, and payment is due April 30, 2022.

The reason behind this is because of the Emancipation Day holiday in Washington, DC, which takes place three day earlier, on April 15. Filing due dates for the 2021 tax return.

STATE OF CA TAX FILE EXTENSION 2016 HOW TO

How to file an extension for taxes?įirstly, it has to be noted that the deadline for filing federal taxes is Monday, April 18, 2022. The undersigned certify that, as of June 18, 2021, the internet website of the California State Board of Equalization is designed, developed and maintained to be in compliance with California Government Code Sections 745, and the Web Content Accessibility Guidelines 2. Hence, it is advisable to file your taxes by Tax Day in the event all your paperwork is ready, even if you can't pay all or part of your taxes. There are those who believe that by filing a tax extension you are handed a postponement on when you should pay your taxes, but this is actually incorrect, as late filing penalties may be imposed on you for each month your return is not filed. If you cannot file by then, you can get an automatic 6-month state tax extension (which moves the deadline to October.

Nero AG - 275,3MB - Commercial - Nero, one of the worlds best-selling multimedia suites, brings the digital world to your PC.

STATE OF CA TAX FILE EXTENSION 2016 PLUS

Non calendar year returns are due within 3½ months following the end of the tax year. file extension 2016 à UpdateStar Plus File Extension Changer. If you owe taxes, payment must be made by Apor penalty and interest will be assessed. Calendar year Colorado business tax returns are due by April 15th. An extension to file your return is not an extension of time to pay your taxes. The deadline to file your taxes in the United States is fast approaching and some of you may need to apply for an extension in the event that you still don't have all the information you need in order to prepare a tax return. You are automatically allowed an extension of up to six months to file your tax return without filing an extension form.

0 kommentar(er)

0 kommentar(er)